Unveiling the Power of Forensic Audit: Protecting Your Business and Uncovering Hidden Risks

Posted: 2024-07-26 23:25:58 | 1686

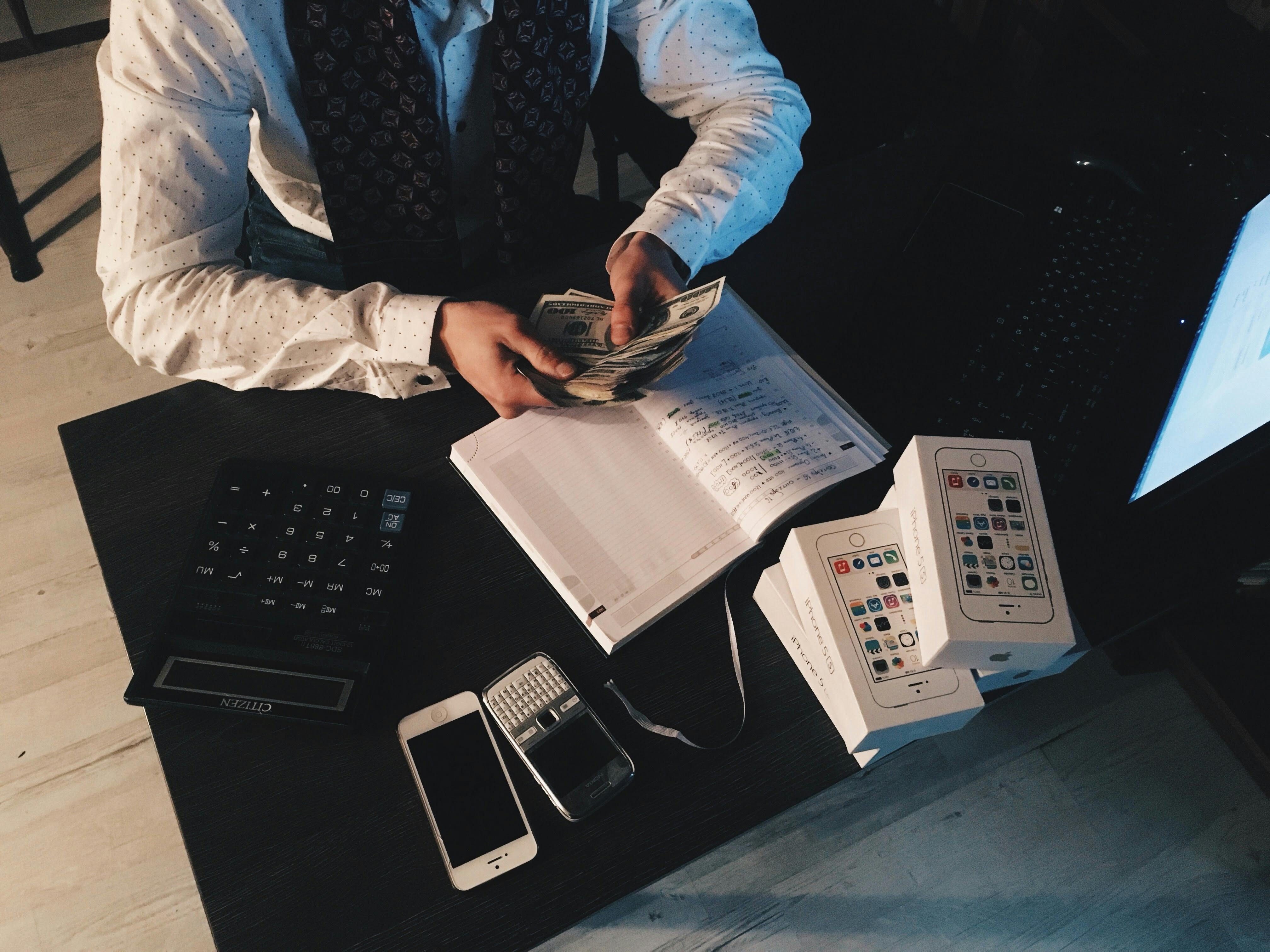

In the dynamic landscape of business operations, maintaining transparency, integrity, and accountability is paramount. However, despite best efforts, financial discrepancies and fraudulent activities can often go unnoticed, posing significant risks to organizations. This is where forensic audit emerges as a vital tool, shedding light on irregularities, mitigating risks, and safeguarding the interests of businesses.

Understanding Forensic Audit

Forensic audit is a specialized examination of financial records, transactions, and procedures conducted with the aim of uncovering fraud, embezzlement, or other irregularities. Unlike traditional audits, which focus on compliance and financial reporting accuracy, forensic audits delve deeper, employing investigative techniques to identify and prevent fraudulent activities.

Attributes of Forensic Audit

1. Thorough Investigation:

Forensic auditors conduct a meticulous examination of financial records, analyzing transactions, accounts, and supporting documentation to identify inconsistencies and irregularities.

2. Specialized Tools and Techniques:

Utilizing advanced forensic accounting software and investigative techniques, forensic auditors can uncover hidden patterns, anomalies, and fraudulent activities that may otherwise remain undetected.

3. Fraud Detection and Prevention:

Forensic audits not only identify existing fraud but also help organizations implement robust internal controls and procedures to prevent future occurrences, minimizing financial losses and reputational damage.

4. Legal Compliance:

Forensic auditors ensure that investigative procedures comply with legal standards and regulations, preserving the integrity of the evidence gathered and facilitating potential legal proceedings.

5. Comprehensive Reporting:

Upon completion of the forensic audit, a detailed report is prepared, documenting findings, recommendations, and actionable insights to guide management in addressing identified issues and strengthening internal controls.

The Importance of Forensic Audit

Forensic audit plays a crucial role in safeguarding businesses from financial risks and fraudulent activities. By proactively identifying and addressing irregularities, organizations can protect their assets, enhance transparency, and maintain trust with stakeholders.

Conclusion

In an increasingly complex and interconnected business environment, the importance of forensic audit cannot be overstated. By leveraging specialized expertise, advanced technologies, and investigative techniques, forensic auditors empower organizations to detect, prevent, and mitigate financial fraud and misconduct effectively. Investing in forensic audit not only protects businesses from potential risks but also reinforces their commitment to integrity, accountability, and ethical conduct.

Forensic audit is not just a reactive measure; it's a proactive strategy for ensuring the financial health and sustainability of businesses in today's dynamic landscape.

We at Prorata Accounting and Consulting (PAC) are committed to helping businesses navigate the complexities of forensic audit and safeguard their interests. Contact us today to learn more about our forensic audit services and how we can assist your organization in mitigating financial risks and ensuring compliance.

#ForensicAudit #FinancialRiskManagement #BusinessIntegrity #FraudDetection #Compliance #Prorataaccounting #PAC